Starting 1 July 2025, all companies operating in Vietnam, including FDI companies, are required to obtain a company e-ID account. Without a valid e-ID, business operations may be disrupted, existing companies could lose access to online tax filings and other essential public e-services, while newly established companies may be unable to obtain approval for VAT e-invoice using from the tax authority.

Nova Law is here to support you in understanding this legal requirement and assist with the registration process, as guided by Decree 69/2024/ND-CP.

1. What is a company e-ID account?

A Vietnam company e-ID account, also known as an organizational electronic identification account, includes a username and password (or other authentication methods) issued by the police authority. It allows companies to access and use the features, services, and applications of the e-ID system and other legally connected information systems in Vietnam.

After registration, the company will be granted a 12-digit identification number required for logging into public e-service platforms in Vietnam.

The company’s e-ID information includes: the identification number of the organization; the organization’s name, including its Vietnamese name, abbreviated name (if any), and foreign name (if any); date of establishment; registered head office address; tax identification number (if any); business registration number (if any); electronic identification code of the organization (if any); full name and personal identification number (or foreigner identification number) of the legal representative who is responsible for applying for the e-ID account.

Beyond procedural convenience, electronic identification for companies and their legal representatives is part of the Vietnamese government’s effort to prevent the creation of shell companies or entities involved in fraudulent activities. It strengthens transparency and accountability across the business landscape in Vietnam.

2. Why do Vietnam companies need an e-ID account?

Vietnam is moving quickly toward digital government services. As of 1 July 2025, Decree No. 69/2024/ND-CP on Electronic Identification and Authentication (“Decree 69”) has officially come into effect. Under this Decree, other government agencies are now requiring companies to use their organizational e-ID accounts to log into public service portals in Vietnam in order to access and utilize those services.

a. E-Tax Portal Notice

The General Department of Taxation under the Vietnam Ministry of Finance, which hosts the national e-tax portal where companies in Vietnam submit tax declarations and payments, has already begun displaying the following notice: “Pursuant to Article 40.4 of Decree No. 69, the Tax Authority requests taxpayers to promptly register an electronic identification account for organizations to ensure convenient access and use of e-tax services.”

Although the notice does not state a specific deadline, companies are strongly encouraged to complete their e-ID registration as soon as possible.

b. Local Tax Departments Also Taking Action

Local tax departments have issued reminders urging companies to complete their e-ID registration. Some notices explicitly state that: “If a company fails to register its e-ID account, after 1 July 2025, it will no longer be able to log into the tax system to file declarations, make payments, or access other tax-related services”

c. Newly-established companies may be refused e-invoice using approval

Some local tax authorities have refused to approve the use of e-invoices if the company has not yet completed its e-ID registration as required under Decree 69.

In summary: it is clear that registering a company e-ID account will be mandatory.

3. Requirements for company e-ID registration

The process of registering a company e-ID account must be carried out by the legal representative of the company, or by a person authorized by the legal representative. This person must use their Level 2 personal e-ID account, to log into the National e-Identification Application (VNeID), provide the required information as instructed, and submit a request to register the company’s e-ID account, with the consent of all other legal representatives of the company (if any), according to Article 12.1 of Decree 69.

Accordingly, the basic requirement is that the legal representative must have a Level 2 electronic identification account.

- For Vietnamese legal representatives, this applies if they have been issued a valid citizen ID card or personal ID card.

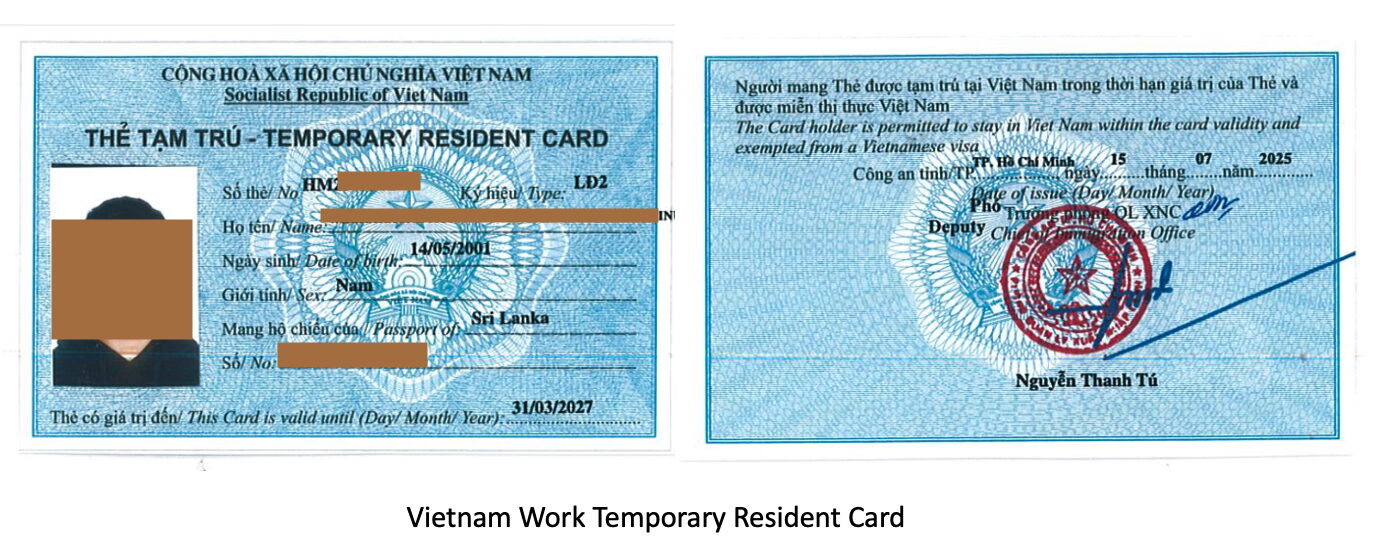

- For foreign legal representatives, this applies if they hold a valid permanent or Temporary Residence Card (“TRC“) in Vietnam.

Please note that even if the legal representative authorizes another individual to submit the request for the company’s electronic identification account, the company’s legal representative is still required to have a Level 2 personal VNeID account.

4. Getting a personal VNeID account for foreign legal reps

The most common approach is for the foreign legal representative to first obtain a TRC, then register for a Level 2 VNeID account.

Step 1. Apply for a Vietnam TRC

Here are the TRC options for a foreign legal representative in Vietnam.

| TRC Type | Process | TRC Duration |

| Working TRC (Requires a Work Permit) | Step 1: The legal rep obtains a Vietnam work permit. Processing time: 2 to 3 months. Step 2: After receiving the work permit, the legal representative can apply for a working Temporary Residence Card (TRC). Note: The legal representative must be physically present in Vietnam during the TRC issuance process. Processing time: 5 to 10 working days. | The TRC is valid for the same duration as the work permit, usually 2 years, renewable |

| Investor TRC (No work permit required, but the investor must contribute at least VND 3 billion to the company.) | Step 1: The investor fully contributes the capital (minimum VND 3 billion) to the company’s bank account and obtains a bank confirmation. Step 2: The legal representative applies for an Investor TRC. Note: They must be in Vietnam during the issuance process. Processing time: 5 to 10 working days. | TRC duration depends on investment amount:

|

| Marriage TRC | Issued to foreigners who are legally married to a Vietnamese citizen. The Vietnamese spouse must provide proof of the marriage and identity documents. The foreign spouse must be in Vietnam during the TRC issuance process. Processing time: 5 to 10 working days | TRC Duration: Up to 3 years, renewable |

Step 2. Register for a Personal VNeID Account (Level 2)

The foreign legal representative must visit the provincial immigration office in person and bring:

- Passport

- TRC

- A Vietnamese mobile number registered under their name and passport number (important)

Immigration Office – Hanoi Public Security Department:

Immigration Office – Ho Chi Minh City Public Security Department

Address 1: 196 Nguyen Thi Minh Khai Street, Xuan Hoa Ward, Ho Chi Minh City

Address 2: 239 Ngo Gia Tu Street, Thu Dau Mot Ward, Binh Duong Province (former location)

Address 3: 120 Pham Hung Street, Ba Ria Ward, Ba Ria – Vung Tau Province (former location)

At the immigration office, the police will take a photo and scan fingerprints of the foreign legal rep. After up to 3 working days, the VNeID account details will be sent via SMS. The legal rep must then activate the e-ID account via the VNeID app or website within 7 days.

Once activated, the foreign legal representative can proceed to register the company e-ID account.

5. How to register a company e-ID account

There are 2 options to register a company’s e-ID account.

Option 1. In-Person Submission

The legal representative or authorized person can complete Form TK02 and submit it in person to the nearest e-id authority or local police office (commune-level police station) that handles ID and authentication services.

Option 2. Online Registration (Recommended)

The company e-ID account can be done online via personal VNeID account of the legal representative. The process is very simple and quick.

The company’s legal representative or an authorized person logs into the VNeID app using their Level 2 personal e-ID account, enters the required company information, and submits the registration request. If the company has multiple legal representatives, consent from all of them is required before submission.

Here’s a YouTube tutorial (00:00–01:09) showing how to register a company e‑ID account on the VNeID app using the legal representative’s VNeID profile. Please enable English auto‑translated subtitles.

It takes 3 to 15 working days to receive the result, a 12-digit company e‑ID code, via a notification in the VNeID app of the applicant.

Need help with your company’s e‑ID account?

Nova Law can assist with:

- Processing work permits, TRCs, investment capital increases

- Registering a Level 2 personal VNeID for foreign legal representatives

- Completing the company e‑ID submission and activation process

Avoid delays in administrative procedures and ensure compliance from the get‑go—just reach out to Nova Law for a seamless, expert‑led journey.